Charity Audit

Ensuring Trust &

Compliance

Audits play a crucial role in UK charities' financial health and transparency.

In this section

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

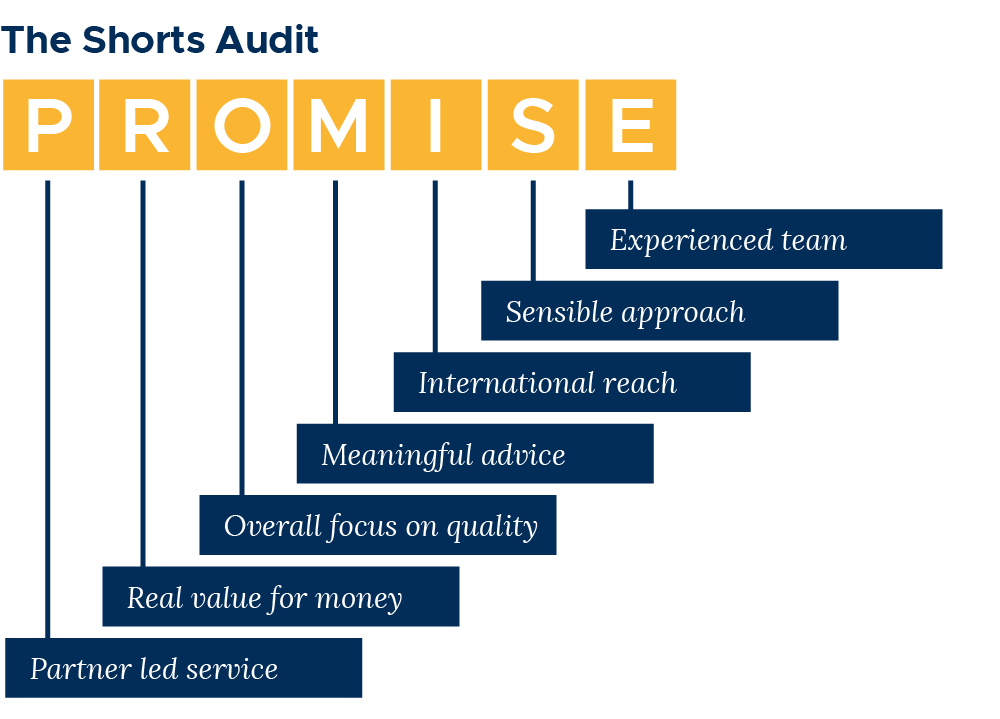

Our Audit team values strong relationships and promises a high-quality audit service, and meaningful advice that your charity can trust.

An audit may be a statutory requirement for your charity, and it must comply with the latest legal obligations and provide maximum assurance to stakeholders.

However, compliance is not the only reason to audit your charity. Audits can provide numerous strategic benefits, such as providing confidence in the financial statements which many charities believe boosts their success in fundraising efforts.

Charity tax rules can also be intricate, necessitating expert advice. Our joined-up team of accountants and tax advisers can help you to navigate these complexities, providing meaningful advice at a strategic level whilst ensuring compliance throughout.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Why work with Shorts for your charity audit?

At Shorts, we understand that charities often have limited funds for professional services, with most resources rightfully dedicated to core charity activities.

This is why our team is committed to guiding charities through an audit process that is efficient and cost-effective, ensuring you reap maximum benefits and value from the service.

As a client of Shorts, you will have a dedicated partner or director assigned to oversee your audit from beginning to end. They will actively participate in the audit process as your primary point of contact. Our aim will ultimately be to know your charity as well as you do.

Shorts has built a strong reputation over the years, and our unwavering focus on quality is why we are highly trusted by charities and businesses throughout the region.

What is the audit threshold for charities?

Charities have different audit thresholds to limited companies.

- An audit is necessary if your charity’s income exceeds £1 million.

- However, an audit is also necessary for asset-rich charities with income over £250,000 and gross assets exceeding £3.26 million.

There are other instances where a charity might need an audit. For example: the trustees might elect to have one; the governing document may require one or there may be some funding an external stakeholder (e.g. funder) who may require one.

Where an audit isn’t required, an independent examiners report might be needed. Our Audit team can advise you on the best course of action.

What accounting standards apply to charities?

Where accruals accounting is observed, compliance with Charity SORP (FRS 102) is mandatory for charities. These accounting standards mirror the FRS 102 for companies but include additional charity specific requirements.

Smaller charities may decide to adopt the cash payments and receipts basis.

The type of charity you run (incorporated or unincorporated) affects where the financial statements must be filed and by what date. Our team can help you understand the reporting requirements for charities and ensure compliance with the filing deadlines.

Our Commitment to Charitable Work

Our dedication to the charitable sector extends beyond the professional services we provide. Our company and individual team members are actively involved in trustee roles, fundraising efforts, and volunteering across various incredible local charities. This hands-on experience enriches our understanding of the unique accounting needs of charities.

Stay Informed: Subscribe to Our Charity Newsletter

Stay updated with the latest news, insights, and tips for managing your charity’s finances by subscribing to our charity newsletter.

Our team of Charity Audit specialists

Meet the team

If you'd like to discuss your needs with a charity specialist within our team,

please complete the form below and we'll get back to you.